Introduction: Investing in the stock market can be a daunting task, especially for beginners. With so many companies to choose from and so much data to analyze, it can be difficult to know where to start. However, one useful tool for navigating the stock market is an earnings calendar. In this article, we will explore the importance of an earnings calendar for investors, how it can be used to make better investment decisions, and answer some common questions about earnings calendars.

Body:

What is an earnings calendar?

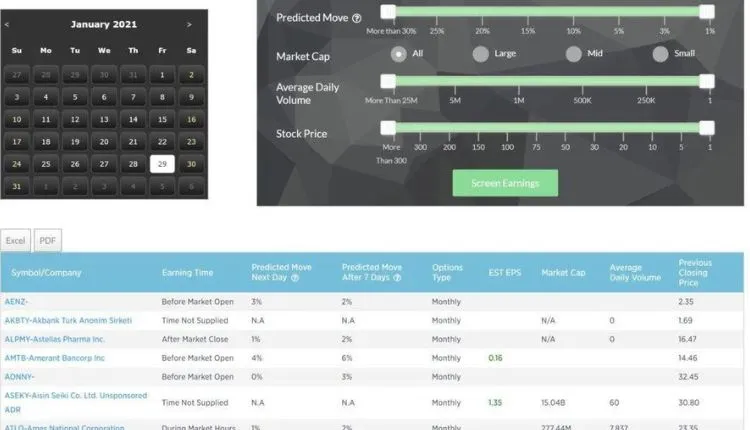

An earnings calendar is a schedule of the upcoming quarterly earnings reports for publicly traded companies. These reports provide information on a company’s financial performance, including revenue, net income, and earnings per share. The earnings calendar lists the dates when these reports are expected to be released, as well as the times and other important details.

Why is an earnings calendar important for investors?

An earnings calendar is important for investors because it helps them stay informed about the latest financial news and market movements. By tracking the release dates of quarterly earnings reports, investors can get a sense of how well a company is performing and how its stock price might be affected. They can also use this information to make better investment decisions, such as buying or selling stocks at the right time.

How can an earnings calendar be used to make better investment decisions?

An earnings calendar can be used to make better investment decisions in several ways. First, it can help investors identify potential buying or selling opportunities based on a company’s financial performance. For example, if a company reports better-than-expected earnings, its stock price may go up, making it a good time to buy. Conversely, if a company reports lower-than-expected earnings, its stock price may go down, making it a good time to sell.

Second, an earnings calendar can help investors manage risk by providing information about the potential volatility of a company’s stock price. For example, if a company is expected to report earnings that are significantly higher or lower than expected, its stock price may be more volatile than usual, which could be a risk for investors.

Finally, an earnings calendar can be used to track trends in a particular industry or sector. By tracking the earnings reports of several companies in the same industry or sector, investors can get a sense of how the overall market is performing and identify potential opportunities or risks.

What are some common misconceptions about earnings calendars?

One common misconception about earnings calendars is that they are only useful for short-term investors or traders. While it is true that an earnings report can have a significant impact on a company’s stock price in the short term, it can also provide valuable information for long-term investors. For example, if a company consistently reports strong earnings over several quarters, it may be a good long-term investment.

Another misconception is that all earnings reports are created equal. In reality, some earnings reports may be more important than others, depending on the company and the industry. For example, the earnings report of a major technology company may have a greater impact on the overall market than the earnings report of a smaller, less well-known company.

A third misconception is that earnings reports are always accurate indicators of a company’s financial health. While earnings reports can provide valuable information, they are just one piece of the puzzle when it comes to evaluating a company’s financial performance. Other factors, such as debt levels, cash flow, and management quality, should also be considered.

Conclusion:

In conclusion, an earnings calendar is an important tool for investors who want to stay informed about the latest financial news and market movements. By tracking the release dates of quarterly earnings reports, investors can make better investment decisions, manage risk, and track trends in a particular industry or sector.